CapitalTime

Articles on investing and capital management, with a quantitative focus.

Why Gold?

2024-10-06

Someone recently asked me why 20% of my portfolio is invested in gold. I put together a list of reasons, and will share them here. First, some important notes:

Gold bullion is just one part of my diversified portfolio. I’m mostly invested in stocks and bonds, which are 80% of the portfolio.

I don’t recommend copying my portfolio. This web site is my investing blog/journal, and I’m not advising others to invest the same way. Please see that link for the reasons why most experts advise against gold.

Reasons I invest in gold

Diversification: Although I could be satisfied with just stocks and bonds, I prefer extra diversification with a third asset class. This additional asset should behave differently from both stocks and bonds.

Gold reduces portfolio volatility: This effect can be easily seen in portfolio back-tests. Including gold alongside stocks and bonds has, historically, reduced volatility and softened crashes (drawdowns). I prefer lower volatility and a smoother investing experience, and this is more important to me than getting the highest return possible.

I believe the post-1971 data is meaningful and relevant: In modern times, gold only began trading freely when the U.S. ended the gold standard in 1971. As a result, we only have 53 years of market prices for gold. Some analysts think there isn’t enough trading history to have confidence in the behaviour and patterns of gold. I disagree, and think 53 years of price data is enough to analyze (and model) gold’s behaviour. In fact, I suspect the post-1990 data might be even more meaningful due to similarity of market regimes.

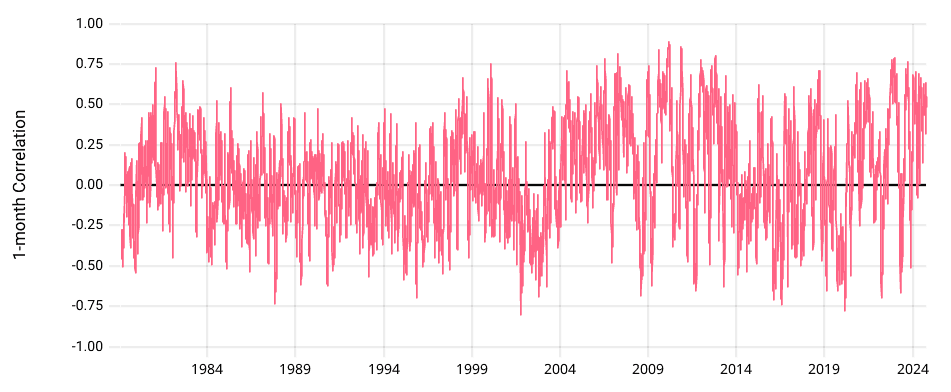

Very low correlation with stocks: To achieve solid diversification, we want to combine assets with low correlations to each other. Gold has virtually zero average correlation with stocks, as shown by testfol.io. In fact, the 1-month correlation chart looks almost random, centered at zero!

More attractive than other alternative assets: Many fund companies pitch various alternative or exotic asset classes. These generally all have active risk and high fees, or are complex, or have limited history. Additionally, these alternatives depend on active management. How do you know if you are picking a skilled/good active manager, rather than a bad manager? I prefer gold, since it has an extensive history and I can passively hold it at very low cost. Many low-fee gold ETFs now exist. Unlike many other alternatives, gold is compatible with basic principles of low-cost passive indexing.

I have experienced the diversification benefit: Gold’s benefits are not just a theoretical back-test for me. I’ve had gold in my portfolio for a while, and have seen the volatility reduction in real markets, including in crashes.

It’s not easy to find a reliable, low-correlation

diversifier: Gold appears to be one of them. Some people

prefer commodity funds, but DBC (for example) is rather

strongly correlated with stocks, at 0.5 correlation coefficient.

REITs are another potential diversifier, but they have an even

higher 0.6 to 0.7 correlation with stocks.

Gold is a well-established global asset: It isn’t as “fringe” as some people make it out to be. Central banks hold $2 trillion of gold and it’s a major FX reserve. Public gold ETFs hold over $200 billion.

Gold is a foreign currency: Gold has interesting characteristics that I like, and I believe that it trades like a currency. I prefer thinking of the price as a currency pair, such as Gold/USD or Gold/CAD. As with any other currency pair, the market reacts to (or anticipates) interest rates, inflation, real rates, government financial condition, and economic health. For example, gold began to strengthen in November 2023 when central banks indicated their plans to reduce interest rates. As central banks (and particularly the Federal Reserve) became surprisingly “dovish” and seemed to favour stimulative policies, those currencies fell relative to gold. This is the kind of behaviour one expects in a currency pair.

— Jem Berkes