CapitalTime

Articles on investing and capital management, with a quantitative focus.

Why You Should Not Use My Risk Parity Portfolio

2022-12-27

I post about my risk parity portfolio frequently on this personal blog or investing journal, because it’s how I invest. I’m not endorsing or recommending it for others.

My portfolio is right for me, but it might not be right for you! It might even be terribly inappropriate for some people. Everyone should do their own research and find a technique that works for them.

Here’s why you should NOT copy or use my portfolio.

Your investment goals might be different

My investment goals might be very different than your own goals. For example, I don’t want high performance.

Many investors do want higher performance, and there are ways to do that. One can use 100% equities, or greater than 100% using leverage. One can also target equity factors such as small caps and value stocks, which may have higher returns over the very long term.

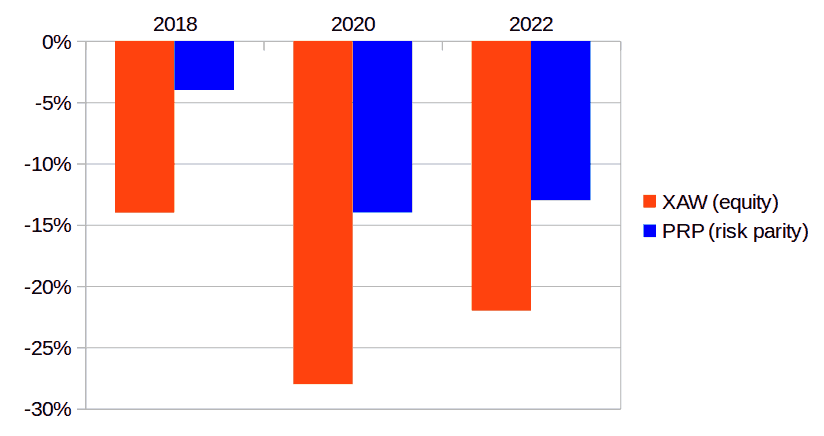

My priorities are different: I want portfolio stability, low

volatility, and diversification beyond just equities. Here’s a

comparison of my PRP allocation versus

XAW, a global equity ETF in Canada. These are the worst

declines (maximum drawdowns) that occurred since I started using PRP

in 2016.

PRP didn’t fall as badly as stocks did, but there’s obviously a

flip side of this: the performance. Since I started using the

portfolio, PRP returned 5.1% annualized. In comparison,

XAW returned 9.0% annualized. That’s a huge

difference!

Who would prefer a 5.1% return to a 9.0% return?

Different investors have different priorities. Do they want to maximize performance? Do they care about declines/drawdowns? Are they comfortable being fully invested in just one asset class (stocks), or do they want to diversify among several asset classes?

Experts don’t recommend gold

My portfolio has 20% in gold bullion. I think this is a good idea, because gold is a well-established global asset that has demonstrated portfolio diversification benefits over the last 50 years.

However, it should be noted that most experts don’t recommend investing in gold for a few reasons:

- Gold has poor long-term performance, around 0% real return

- Gold has limited market data

- The market data after 1970 may be anomalous and unreliable

I think these are good points, and an investor should think carefully before adding gold to their portfolio. There is a danger that gold could reduce portfolio performance without adding any benefit.

I’m aware of these criticisms, but I have a different perspective. I think that the last 50 years of data is meaningful. I also think there is value in diversifying beyond just stocks (and bonds), and gold is a simple and low-fee “alternative asset” to achieve that.

In any case, experts in this field usually advise against gold.

I like certain ETFs for personal reasons

I chose certain ETFs that I have very high confidence in. I believe it’s important to use investment vehicles that one can believe in, so that one can “stick with” them during the hard times.

However, these are personal choices. I have tremendous confidence in XIU, one of my

core holdings. This confidence is based on experience trading and

investing in XIU for about 20 years.

I have experienced three market crashes (2001, 2008, 2020) with

XIU and two crashes (2008, 2020) with XBB.

I like how they held up through these severe crashes.

My preference for these ETFs comes from my own personal history with them. That probably is not meaningful for anyone else.

— Jem Berkes