CapitalTime

Articles on investing and capital management, with a quantitative focus.

Is This a Market Bottom?

2022-09-09

Since we just had a large drawdown (23% drop in stocks), could this be a market bottom and the start of a new rally?

I can’t remember who suggested this, but I heard an analyst say that previous market bottoms occurred when short-term bond yields were declining. The short term rates (such as 2-year and 5-year bond yields) tend to decline when the central bank cuts rates, or the market anticipates lower interest rates ahead.

I looked at each bottom in the S&P 500 going back 32 years. There were seven bottoms following large drawdowns, which marked the starts of new rallies. For each of these historical bottoms, I looked at the preceding six months for the 2-year treasury yield.

Throughout this text, I will use the term “interest rate” to refer to the yield on the 2-year US treasury bond. Each chart shows this bond yield = interest rate.

Let’s see if there’s a pattern.

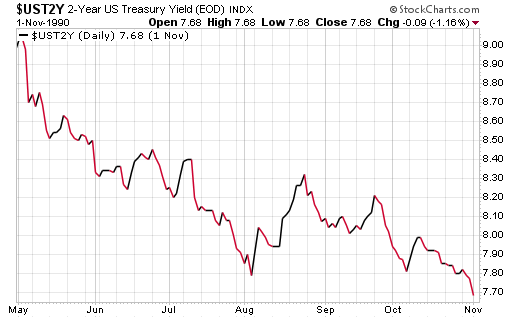

1990-11-01

There was a recession in 1990. At the time of the stock market bottom in November (the right end of the chart), interest rates had been declining for several months.

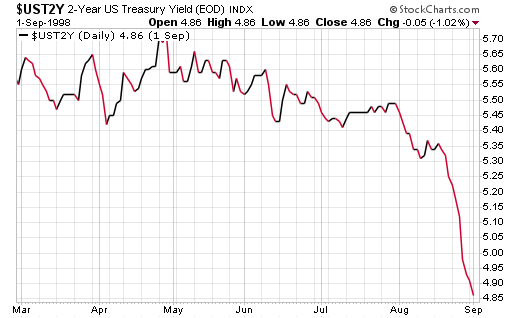

1998-09-01

Long-Term Capital Management (LTCM) started to collapse in 1998, with disastrous losses becoming worse in the summer. The Federal Reserve organized a bailout in September 1998, which is also when the stock market bottomed.

Interest rates declined before the market bottom.

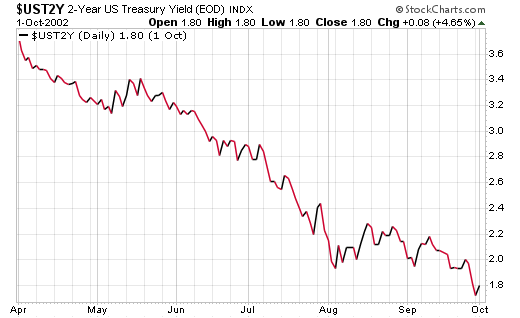

2002-10-01

The massive dot-com crash and bear market eventually bottomed in October 2002. Interest rates steadily declined in the preceding months.

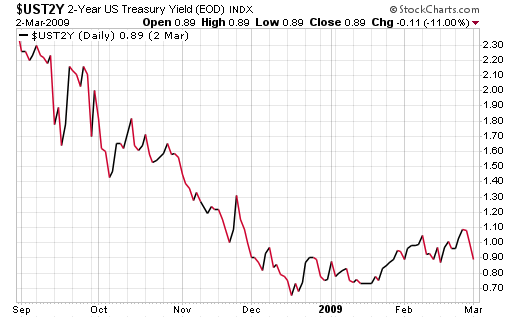

2009-03-01

This was the market bottom after the 2008 financial crisis. Interest rates declined in the preceding months, though there was a very slight increase near the market bottom.

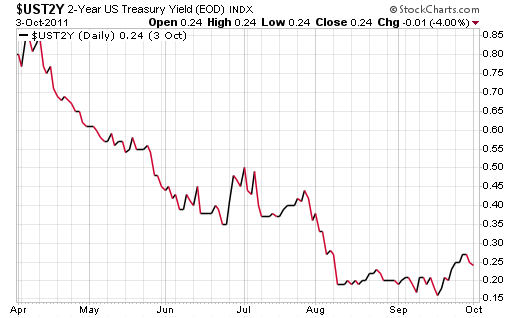

2011-10-01

I can’t remember the story of the 2011 market decline, but it was yet another serious drawdown and market bottom.

Interest rates generally fell in the preceding months.

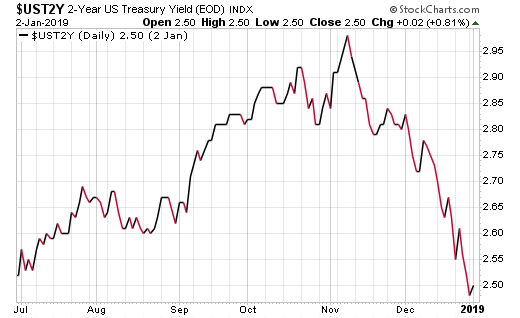

2019-01-01

This was the “taper tantrum”, when the stock market reacted badly as the Federal Reserve attempted to tighten monetary policy. Ultimately, Jerome Powell gave up on tightening and stopped the rate hikes.

Here, interest rates trended up, then fell sharply as the stock market bottomed. I think this is the only instance where interest rates did not steadily decline before the market bottom.

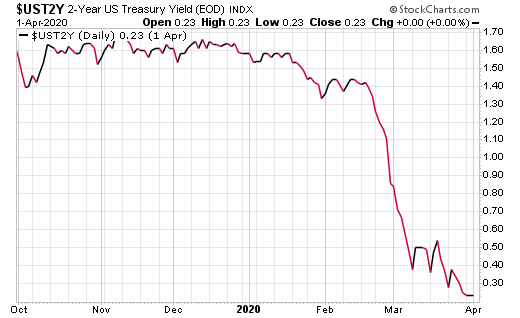

2020-04-01

Interest rates were clearly declining before the market bottom of the COVID crash.

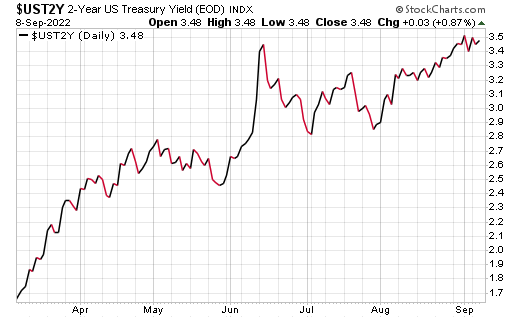

How about today?

Interest rates are steadily rising. This does not look anything like the bond yields during previous market bottoms.

Conclusions

Here’s a review of the historical market bottoms. During 6 of the 7 previous market bottoms (86% of cases), interest rates were falling.

| Market bottom | 2 year bond yield |

|---|---|

| 1990-11-01 | Falling |

| 1998-09-01 | Falling |

| 2002-10-01 | Falling |

| 2009-03-01 | Falling |

| 2011-10-01 | Falling |

| 2019-01-01 | No clear trend |

| 2020-04-01 | Falling |

Today, interest rates are rising sharply. Over the last 32 years, there has never been a stock market bottom during a period where interest rates were rising like this.

Most bottoms happened while yields were falling, which certainly is not happening right now.

But, these indicators are pretty flaky.

This particular indicator suggests that stocks have not yet hit a bottom. Then again, I only looked at seven previous instances, and seven is a very small sample.

It doesn’t necessarily mean anything. Perhaps this will be the first time that stocks will bottom while yields are rising. There is a unique situation today that’s unlike the previous seven market bottoms: we have very high inflation, and bonds are in a severe bear market. This makes the current scenario different from the last 32 years.

It’s best to stick with one’s systematic investment strategy. I’m not going to attempt to “time” the stock market based on this indicator. I continue to be fully invested in my asset allocation, along with slight modifications to my stock exposure which are driven by my algorithm-based trend strategy.

— Jem Berkes