CapitalTime

Articles on investing and capital management, with a quantitative focus.

Choosing My Asset Allocation

2019-08-13

I’ve described some details of risk parity, but I should explain how I arrived at my PRP asset allocation. There is no ideal single asset allocation that suits everyone. Because personal priorities and tastes factor into all of this, I cannot tell anyone else what they should do. Here, I will describe my own thought process, and how I got to PRP.

All of the following are passive or index-based portfolios, along the lines of the couch potato method.

The Permanent Portfolio

When I first started researching asset allocations, Harry Browne’s Permanent Portfolio (PP) interested me a great deal. It’s a passive approach with equal weights: 25% stocks, 25% long bonds, 25% gold, 25% cash.

I like that PP has four distinct asset classes, intended for different economic environments. Harry Browne believes that we can’t predict markets or anticipate what kind of economy lies ahead. PP contains assets which respond to different possible economic conditions (for example, stocks do best in a normal growth environment, and gold does best in a high inflation environment). The idea is that PP generally responds well in all economic environments.

The PP does have impressive characteristics and surprisingly low volatility, thanks to its many uncorrelated asset classes. If you’d like more information on it, take a look at

After adopting the PP, I started to encounter some problems, mostly relating to the practical implementation.

Cash weight. Cash does not perform well over the long term, and PP has 25% in cash. All investors need to keep some cash for immediate living expenses and an emergency fund, but putting the cash inside the investment portfolio is very awkward. For one, it means that the cash gets locked inside retirement accounts (RRSP and 401k) where it can’t be accessed! Secondly, if the portfolio were to grow large over time, there would be far too much (unproductive) cash.

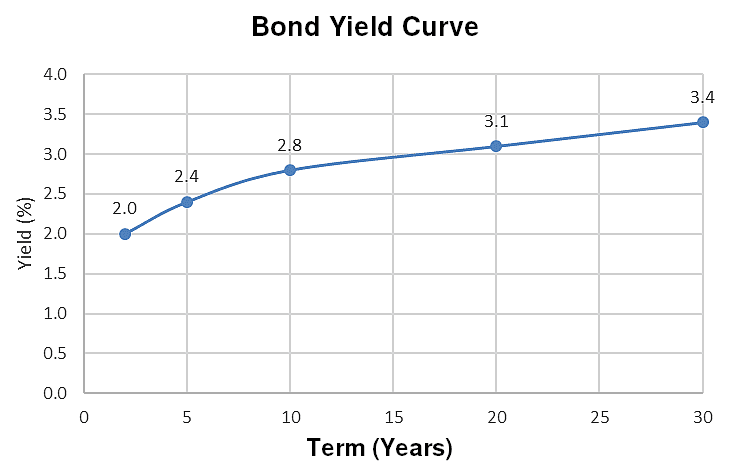

Long bonds. The PP uses long-term bonds. In the US, this means treasury bonds that are 20-30 years out on the yield curve. While this may work fine in the US, Canada’s government bond market is not as large, and there isn’t a great way to invest specifically in long term bonds. For example, while the American TLT fund holds 25+ bonds at relatively even weights, the Canadian ZFL fund holds just 10 bonds, and 40% of the fund is concentrated in just two issues. I’m not convinced that long term bonds are a good asset class for a Canadian investor. ZFL may be fine, but I’m not convinced.

Much later, I realized that the bonds and cash can be grouped together. Cash is just a point on the yield curve at 0 years. With half at 0 years and half (the long bonds) at 25 years, these two assets are equivalent to holding diversified bonds of many maturities, with an average maturity of 12 years. This is almost exactly the composition of the industry-standard XBB and VAB funds!

Though I did not see this initially, I now believe one can implement the PP as 25% stocks, 50% bonds, and 25% gold.

All Weather

As I struggled with the aspects of the PP that I didn’t like (before coming to the above realization), I went looking for other portfolios with similar asset classes.

I learned that Ray Dalio, the head of Bridgewater, had shared a version of his famous All Weather Fund with Tony Robbins, who then published it in his book. This is quite interesting, because Bridgewater’s All Weather fund has many similarities with PP; it’s designed to handle different economic conditions, with almost the same philosophy as Browne’s PP.

The hedge fund’s All Weather is more complex, but the simplified version is a passive portfolio that can be very easily implemented. My own back-tests with the portfolio showed very promising historical results. It turns out All Weather is a risk parity design; I didn’t know this when I first encountered it, but it does explain the impressive risk-adjusted returns.

I also think that the All Weather formulation can be distilled down a bit further. The publicized version has 15% intermediate term bonds and 40% long term bonds. These are simply different points on the yield curve. If combined, it’s equivalent to 55% weight in bonds at approx 16 years.

The only thing I didn’t like about All Weather is the commodity portion, at 7.5%. I don’t believe there is any great way to carry long term exposure to diversified commodities. The DBC fund that’s often used for this purpose is very energy-heavy, with about half in oil and fuel. I personally think this is too economically sensitive to work as a good diversifier, and commodity funds also don’t have a great track record.

Making some simplifications to the All Weather description, it can be described as: 30% stocks, 55% bonds, 15% commodities.

Risk Parity

Once I learned about the risk parity concept, I tried deriving my own risk parity portfolio from scratch. This let me focus on the three assets that I like from PP: stocks, bonds, gold.

The resulting weights turned out to be 30% stocks, 50% bonds, 20% gold.

Candidate Portfolios

These portfolios are starting to look very similar. Here are the allocation of each, including the average maturity on the yield curve (Yrs) for the bond component. I’ve used the simplifications from earlier:

| Portfolio | Stocks | Bonds | Yrs | Commodities |

|---|---|---|---|---|

| PP | 25% | 50% | 12 | 25% (gold) |

| All Weather | 30% | 55% | 16 | 15% (broad) |

| My risk parity | 30% | 50% | 10 | 20% (gold) |

A few % difference in a weight really doesn’t make much of a difference. The only significant differences are the points on the yield curve, and the weight in commodities (min 15%, max 25%).

I decided to adopt my own risk parity design, which I named PRP (Permanent Risk Parity), as it is almost identical to the Permanent Portfolio.

Confidence in the Portfolio

I think it’s important to have confidence in one’s investment strategy; a timid investor can easily get scared out of markets, or give up on their strategy during a bad period. I want to make sure that I have confidence in my strategy.

Harry Browne introduced the PP allocation in 1987. It’s a simple strategy with an amazing 32 year track record in the real world; this isn’t a theoretical back-test.

I derived the PRP allocations using a quantitative (not economic) theory and historical data mostly after 1987. And I ended up with an asset allocation that is just about identical to Browne’s PP! This is quite amazing.

The fact that two completely separate design approaches gave the same answer is very reassuring, and gives me confidence in the portfolio. There’s additional encouragement from billionaire Ray Dalio’s All Weather allocations.

— Jem Berkes