CapitalTime

Articles on investing and capital management, with a quantitative focus.

Risk Parity - Basics

2019-06-24

Harry Markowitz, recipient of the Nobel Prize in Economics, called diversification “the only free lunch in finance”. The popular balanced funds such as 50/50 and 60/40 do a good job with diversification, but I think it’s possible to do better using Risk Parity. This approach improves on portfolio diversification and risk.

(Also see: What is Risk?)

My version of this, Permanent Risk Parity (PRP), is 30% stocks, 50% bonds (or fixed income), 20% gold. My model portfolio implements this using four low-cost ETFs suitable for Canadian investors. I don’t use exactly my model portfolio, but this provides a useful benchmark and guideline. I do follow the exact allocation weights.

Note: this portfolio isn’t for everyone! It is of critical importance that you choose and commit to an asset allocation that you can be comfortable with no matter what happens in the market. I’ve chosen PRP because I’ve been convinced by the theory, historical record, and my own experience with it.

Balanced funds aren’t well diversified

The industry standard balanced fund has 60% stocks and 40% bonds, referred to as 60/40. While the % weights make it look evenly diversified, stocks actually have much greater risk and reward than bonds. This means that 60/40 is highly concentrated in stocks (both for risk and reward). Depending on how one measures risk, the exposure to stocks is around 80% - 90%.

This turns out to be a good thing as long as stocks are going up. The returns of 60/40 are high when stock returns are high. The problem is that the portfolio is not actually diversified; the impact of stocks is far greater than bonds.

Risk Parity

Risk parity is a portfolio design approach which weights or scales the investments so that all holdings have equal risk. There are two assumptions underlying risk parity:

- Different asset classes have different risk levels

- Long term, the reward for taking risk is the same for all asset classes

An interesting consequence is that if you weight the assets to equalize the risk, you’ll also equalize the expected long term reward. Clearly, the result would be strong diversification: all assets would contribute equally to the risk and return of the portfolio. No single asset would dominate the portfolio.

Consider just stocks and bonds using maximum drawdown as the risk metric. Stocks have routinely declined about 60%, and bond funds have declined about 20% in the worst case.

| Asset class | Risk metric | Weight | Resulting risk |

|---|---|---|---|

| Stocks | 60 | 25% | 15 |

| Bonds | 20 | 75% | 15 |

The weights shown above equalize the risk of the two holdings. With risk spread evenly across multiple assets, the overall portfolio is less volatile.

Risk is one side of diversification. How about reward? Consider what happens during the good years for the assets, in their bull market phase. Let’s use a $100 portfolio.

Stocks: a good year may bring a 12% return. With $25 allocated, that brings a reward of $3.

Bonds: a good year may bring a 4% return. With $75 allocated, that brings a reward of $3.

Both assets can contribute equally to the portfolio’s return. Again, this illustrates good diversification. With the risk parity weightings, both the potential upside and downside are equal, for all assets.

For a deeper dive into these concepts, and response to criticisms, see Myths and facts about risk parity by Matthew C. Klein, economics commentator at Barron’s and former associate at Bridgewater. It should be noted that Bridgewater and its founder Ray Dalio have pioneered this methodology, with excellent long term results.

The allocation weights that I arrived at are based on my own risk parity design, but similar to Harry Browne’s famous Permanent Portfolio and Ray Dalio’s simplified All Weather portfolio. All three methods have similar allocations, and I nudged my weights towards multiples of 10 for elegance. This is all just a pseudoscience after all, and small differences in weights makes no difference.

There is also a (surprising) equivalence between PRP and the Permanent Portfolio.

A third asset class

Balanced funds contain stocks and bonds because these two asset classes behave very differently. Diversification requires assets which behave differently and don’t move together. You don’t want both asset classes to crash at the same time, for example.

It turns out that gold bullion is another asset class which behaves very differently from both stocks and bonds. In mathematical terms, it has low correlations with both stocks and bonds.

Another asset class with low correlations is real estate. Although REITs are a proxy for real estate, I think they are an imperfect proxy and don’t offer as solid diversification as gold. To keep PRP simple, I decided to use gold.

But stocks always perform best!

A frequent response I hear is that, historically, stocks have always performed best. So even though adding bonds and gold reduces portfolio volatility and improves diversification, why bother with any of this? Why not just go 100% stocks, or stick with the stock-heavy 60/40 ?

First anwer: I want lower volatility and less vulnerability to bear markets in stocks. Stocks can do badly for long stretches of time (decades) and I would rather not have to sit through those bad periods. Less volatility is more comfortable for me, and also gives me more flexibility to withdraw money at arbitrary times if I want to.

Second answer: there is no guarantee that stocks will perform best in the long term. Much of today’s enthusiasm about stock-heavy investing is based on stellar US returns since the early 1980s. There have been other periods in time where other asset classes had superior returns.

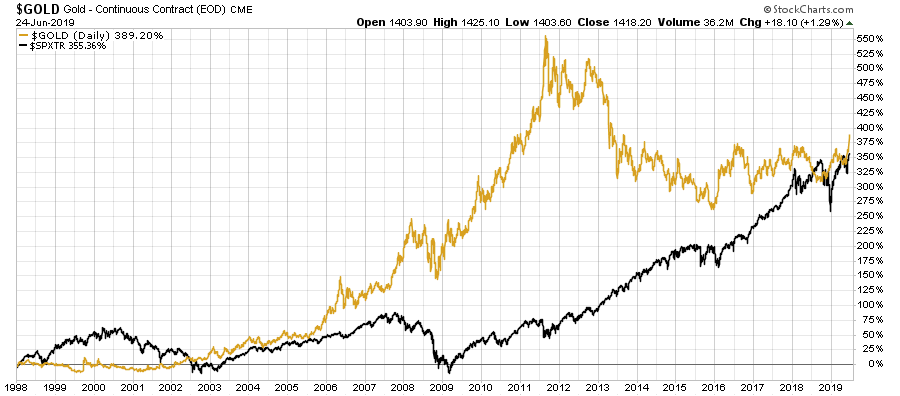

Consider, for example, 1998 to now (over 21 years) during which gold has outperformed stocks. In the chart below, the S&P 500 total return is shown in black, and gold bullion is shown in gold.

I can’t predict which asset class will perform best for any X years going forward. For example, it would be a mistake to look at just this performance since 1998 and conclude that I should invest everything in gold. Similarly, it would be a mistake to just look at US stock performance since 1982 and conclude that I should invest everything in stocks.

Different assets do well in different time periods. By taking a diversified bet across several different asset classes, it’s possible to benefit from whatever turns out to be the strong one. PRP, like other risk parity approaches, does this without bias towards any particular asset. The portfolio weights are designed to allow equal impact from all assets.

It’s important to remember that there will be long stretches where an asset may not perform. For example, gold performed poorly from 1980-2000, and stocks performed poorly from 2000-2012. With the PRP approach, you still need to hold the asset which appears to be useless at the time.

Comparing 60/40 to PRP

With the 60/40 allocation:

- Nearly all risk & reward is concentrated in stocks

- Stocks dominate the movement

- There are 2 asset classes in total

- Risk/maximum drawdown is ~ 30%

With PRP:

- Risk and reward is uniform across all asset classes

- No single asset class dominates the movement

- There are 3 asset classes in total

- Risk/maximum drawdown is ~ 15%

Performance

Back-tests with historical data show that the PRP allocation has approximately the same performance as a 50/50 balanced fund, and less performance than 60/40.

According to the 22 years of performance data I have for my PRP model portfolio, the annualized performance was 6.0%. For comparison, a 60/40 portfolio with the same US & Canadian stock mix returned 6.5% annualized. Both figures include fees.

Using the backtest tool at Portfolio Visualizer, with 30% US stock market, 50% 10-year treasury bonds, 20% gold, the historical return since 1972 has been 9.1% annualized. For comparison, the 60/40 portfolio returned 9.6% annualized.

Both of these comparison (the Canadian PRP using my own dataset, plus a US version of the PRP with longer dataset) show only slighter lower performance compared to 60/40. At the same time, PRP has much lower risk (half the maximum drawdown) and has delivered much more consistent annual returns over time.

— Jem Berkes