CapitalTime

Articles on investing and capital management, with a quantitative focus.

PRP Annual Performance

2026-01-14

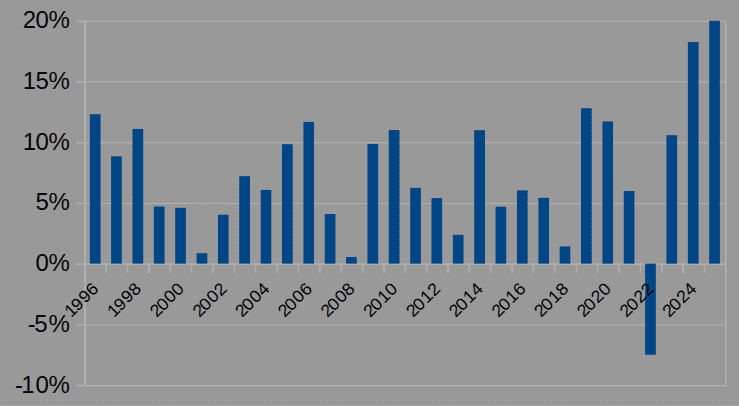

The PRP allocation was up 20.4% in 2025. This was the highest-performing year in my historical data (30 years). I began using the portfolio in 2016.

Long-term performance is 7.2% CAGR over 30 years. This is theoretical performance based on my historical data. The long-term performance starts with my original asset allocation, then switches to the new allocation in 2024. All figures are in CAD currency and include ETF expenses.

Please note: this web site is a personal investing journal. Don’t use this portfolio.

Historical Annual Returns 1996-2025

Risk

Historical back-tests for this asset allocation show -25% maximum drawdown, but the more common drawdown was -15%.

— Jem Berkes