CapitalTime

Articles on investing and capital management, with a quantitative focus.

I Expect Returns to Come Down

2025-09-25

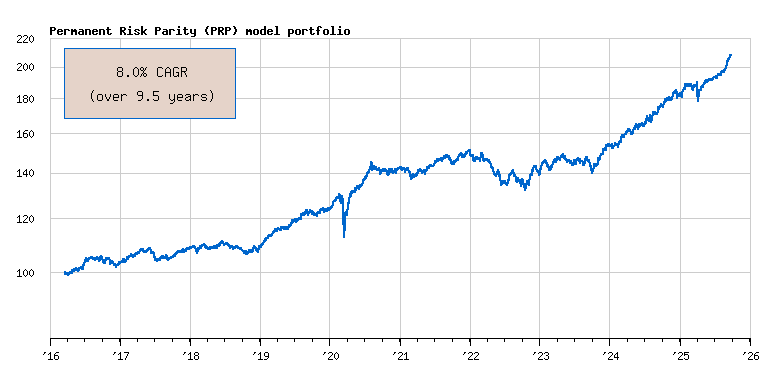

I track my portfolio’s performance since inception. This full-period CAGR is currently 8.0% — the highest I’ve seen since I began using the risk parity strategy.

8% is high compared to historical returns, so I expect to see my performance come down, somewhat. This could happen if the markets drop or have weak performance for a while.

Historically, my PRP allocation returned 6% to 7% CAGR, and multi-year rolling returns have been as low as 3% CAGR.

The current 8% return is higher than all of these numbers, which is why I expect to see my performance come down.

On the other hand, if we continue to have high inflation (perhaps above 3%), then these returns may be normal. In this high-inflation scenario, the real returns would actually be in line with historical performance.

Should I do something?

No, I’m leaving my portfolio alone. I’m just observing that the PRP return since inception is higher than historical returns.

There are many ways this can be resolved (mathematically):

- Stocks could remain strong, but weaken a bit.

- Stocks could weaken, without a dramatic drop.

- Stocks could crash and burn.

- Inflation could remain high, justifying this performance.

— Jem Berkes