CapitalTime

Articles on investing and capital management, with a quantitative focus.

#prp - Permanent Risk Parity (how I invest)

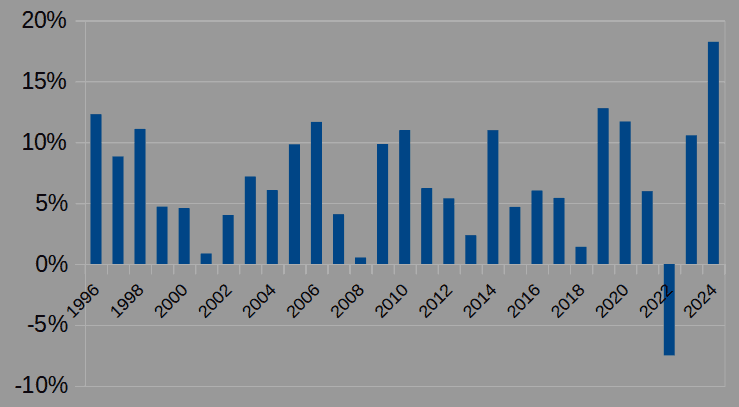

PRP Annual Performance

2025-02-24

The PRP allocation was up 18.2% in 2024. This was the strongest year in my historical data. Trailing 3-year and 5-year CAGR are both in the 6% to 7% range, consistent with long-term historical performance.

Long-term performance is 6.8% CAGR over 29 years. This is theoretical performance based on my historical data. The long-term performance starts with my original asset allocation, then switches to the new allocation in 2024. All figures are in CAD currency and include ETF expenses.

Please note: this web site is a personal investing journal. Don’t use this portfolio.

Historical Annual Returns 1996-2024

— Jem Berkes