CapitalTime

Articles on investing and capital management, with a quantitative focus.

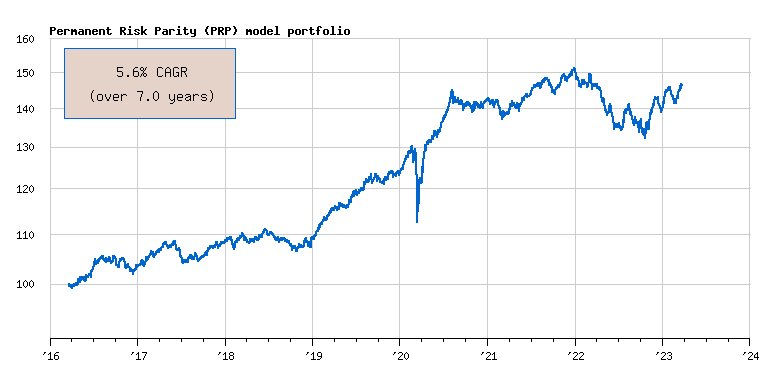

Seven Year Portfolio Anniversary

2023-03-25

I started my PRP portfolio 7 years ago. Over these years, PRP has returned 5.6% CAGR.

This return is somewhat lower than the historical performance. Canadian inflation averaged 2.8% over this period, so PRP still has a positive real return.

I’m comfortable with this portfolio. I was able to “stick with the plan” through both the crash of 2020 and volatility 2022.

Performance

I will compare my portfolio to XBAL, a low-fee 60/40

balanced fund which has some of the same holdings. Both portfolios

are bond-heavy and have a home country bias.

The performance of XBAL over 7 years was 5.3% CAGR,

in the same ballpark as PRP. Note that PRP had lower volatility than XBAL.

— Jem Berkes