CapitalTime

Articles on investing and capital management, with a quantitative focus.

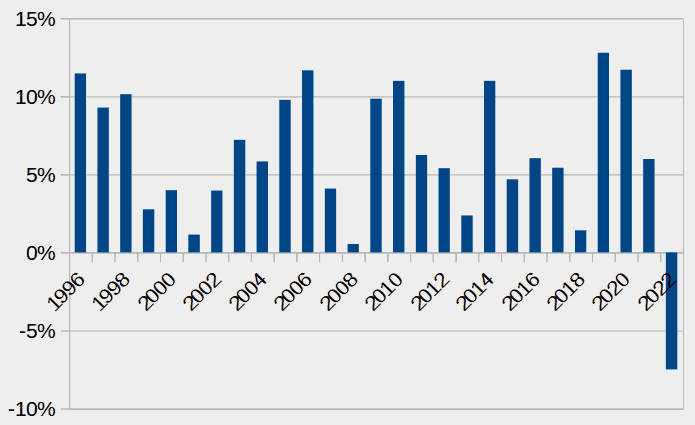

PRP Annual Performance

2023-01-05

The PRP allocation declined -7.5% in 2022. This was the worst calendar year loss in my historical data.

Long-term performance is 6.1% CAGR over 27 years. This is theoretical performance based on historical data that I was able to find. All figures are for the Canadian PRP in CAD currency.

Please note: this web site is a personal investing journal. Don’t use this portfolio.

Historical Annual Returns

Although this is the worst year I have recorded so far, the portfolio behaviour is consistent with my back-tests and Monte Carlo simulations. I previously noted that “a 5% to 10% single year decline would be normal”, and that’s exactly what happened this year.

The actual peak-to-trough drawdown was only slightly worse than previous historical episodes. In 2022, most of the drawdown happened to align with the calendar year (unlike 1974, 1980, 1981, 2008).

The 2022 performance was unfortunate, but negative years will sometimes happen. As explained here, I believe this decline is within “normal”. In absolute terms, a 7.5% loss is quite mild.

— Jem Berkes