CapitalTime

Articles on investing and capital management, with a quantitative focus.

Bonds Are a Good Investment

2022-05-06

Researchers have updated (and corrected) historical stock and bond data, providing a more complete picture of historical returns.

The updated market history contains a big surprise. It shows that bonds have frequently outperformed stocks, even over very long time periods!

To me, this looks like a powerful argument for including

aggregate bonds (something like XBB or

AGG) in a diversified portfolio. The historical record

shows that bonds are a good investment, with the potential to

perform as well as stocks.

Note 1: History shows that bonds have performed well in the past, but this doesn’t guarantee they will perform well in the future. They could have terrible performance going forward.

Note 2: I’m not a financial professional and this is not investment advice. I recommend checking out the Rational Reminder podcasts from PWL Capital for more information on diversification using bonds. Episode 199 discusses these topics.

A better historical record

The paper by McQuarrie describes the new historical findings.

Many investors think that stocks always outperform bonds over long enough time spans, such as 20-30 years. McQuarrie describes the source of this legend, and mentions that the author of the famous “Stocks for the Long Run” book had used very limited data sources.

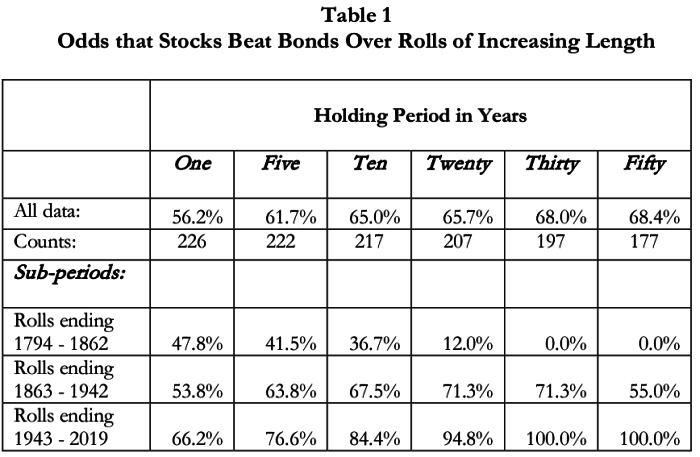

Using a diversified bond fund that includes corporates (as I do in my asset allocation), it turns out that even over very long periods, stocks outperformed bonds about 2/3 of the time. The other 1/3 of the time, bonds actually beat stocks! Here is a key figure from the paper:

Historically, stocks have tended to outperform bonds. It’s just not as much of a “slam dunk” as many people believe.

So what?

Looking at this more complete historical record, it seems that bonds have quite frequently been solid investments — sometimes better than stocks.

We have no idea what the future will bring. In the years ahead of us, either stocks or bonds could turn out to be the superior investment. There’s no way to know which asset will outperform.

I think that investors should resist the temptation to extrapolate the current (post-war) period. The amazing outperformance of stocks since 1943 may not continue forever. If we look at the wider historical record, it does appear that bonds have generally been a good investment.

— Jem Berkes