CapitalTime

Articles on investing and capital management, with a quantitative focus.

Six Year Portfolio Anniversary

2022-03-22

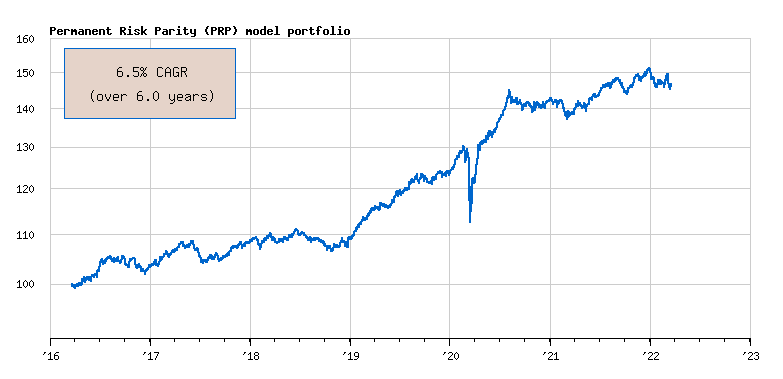

I started my PRP portfolio exactly 6 years ago. Over these years, PRP has returned 6.5% CAGR.

This is a good return, on par with historical performance. The portfolio is beating inflation, which has averaged roughly 2.5% over this period (Canada).

Perhaps just as important: I have found that I’m comfortable with this portfolio. I was able to “stick with the plan” through the 2020 crash, and I’ve steadily added new money to it.

Performance

I will compare my portfolio to XBAL, a low-fee 60/40

balanced fund which has some of the same holdings. Both portfolios

are bond-heavy and have a home country bias.

The performance of XBAL in this period was 6.6%

CAGR, practically the same as PRP.

Drawdowns

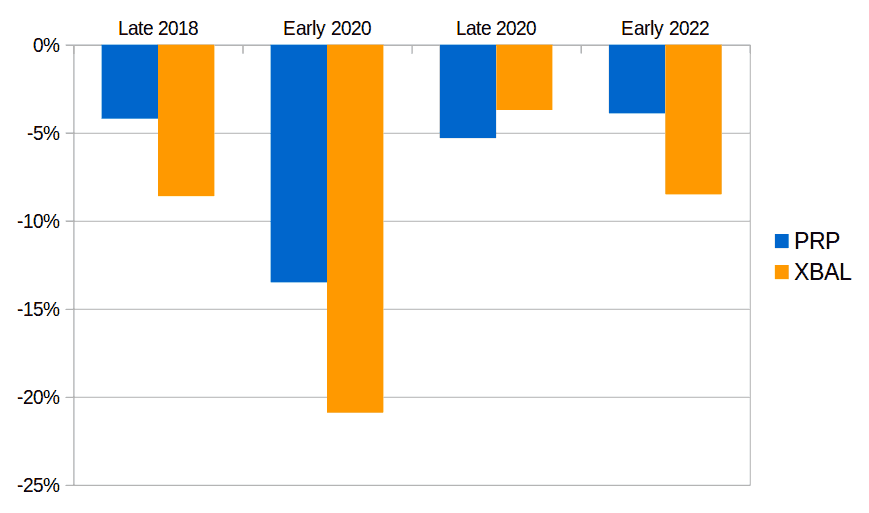

One of the goals of

PRP is to limit drawdowns and minimize volatility. Let’s see how

PRP compares to XBAL in this regard.

The chart shows drawdown which exceeded 5%.

On average, PRP seems to have milder drawdowns than the balanced fund.

— Jem Berkes