CapitalTime

Articles on investing and capital management, with a quantitative focus.

Investment Portfolio Goals

2021-11-14

I’ve been using the PRP investment portfolio for a while now, and thought it would be good to review my goals. Here’s what I want this portfolio to do:

- Provide a positive real return

- Limit drawdown (losses) and minimize volatility

The portfolio is successful if these two things are happening.

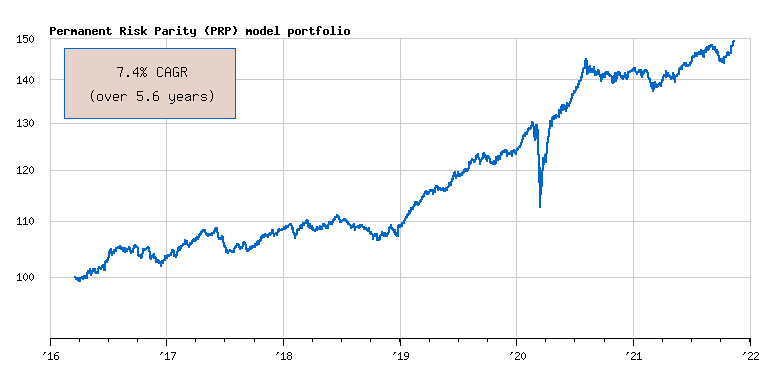

As a portfolio fluctuates over time and enters periods of bad performance, an investor can become concerned about the results. In order to focus my attention on what truly matters, I’ve added the compound annual growth rate (CAGR) to my automatically generated portfolio chart. At a glance, this reminds me that I should only care about the long-term performance.

Currently, the long-term CAGR is 7.4% which is higher than I expected. The annual inflation rate over these years has been roughly 2% (even with the recent sharp rise), so my portfolio has delivered a solid, positive real return.

How about the drawdown and volatility? The portfolio has been successful in this respect as well. In late 2018, when stocks fell sharply, PRP had a maximum drawdown of just 4%. The more serious test was the 2020 COVID-19 crash, and PRP had a maximum drawdown of 14%.

— Jem Berkes