CapitalTime

Articles on investing and capital management, with a quantitative focus.

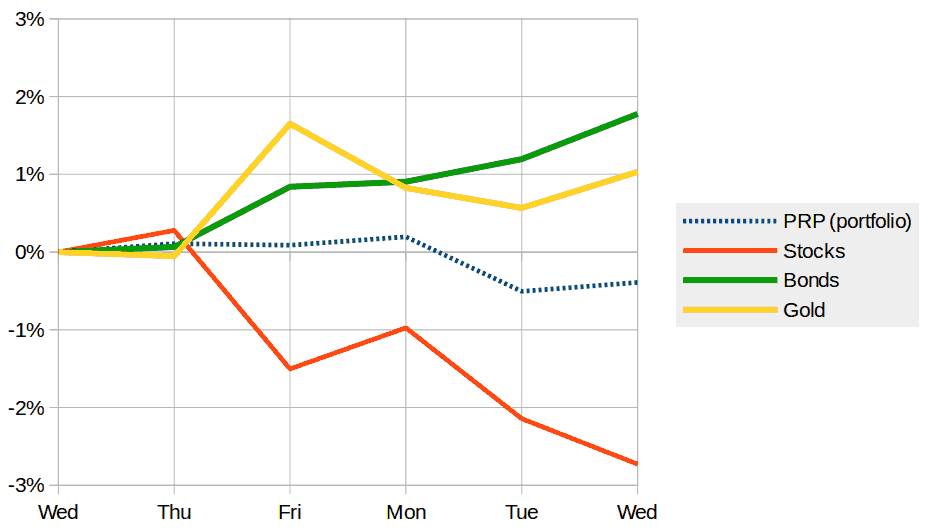

Here’s Diversification In Action

2021-12-02

The markets have been a bit volatile over the last week. Although this is a very short timeframe, the last week provides an example of how diversifying into several distinct asset classes helps to reduce volatility, giving a smoother ride.

Stocks in this chart are XAW for a simplified view

of global equities (this isn’t exactly what I hold, but it was

easier to chart). Bonds are XBB. Gold is

CGL.C, and everything is priced in CAD.

PRP (my portfolio) is the dotted line. This is the sum of the other asset classes.

This shows diversification in action. Notice how the various asset classes made sharp movements in the first few days. However, PRP — the “sum” — was basically flat from Wednesday to Monday, and has moved by less than 0.5% since the start!

A diversified portfolio is not immune to catastrophes, and can still plummet in value. However, it seems to be a smoother ride overall.

— Jem Berkes