CapitalTime

Articles on investing and capital management, with a quantitative focus.

Reflecting on BullSignals During Covid

2021-07-11

I continue to run my algorithm-based trend following strategy, to a limited extent. I keep this in a separate account so that I can easily track the performance. There have not been any BullSignals updates on my web site for a while, because the algorithm has been “long” ever since the Buy signal on 2020-06-08.

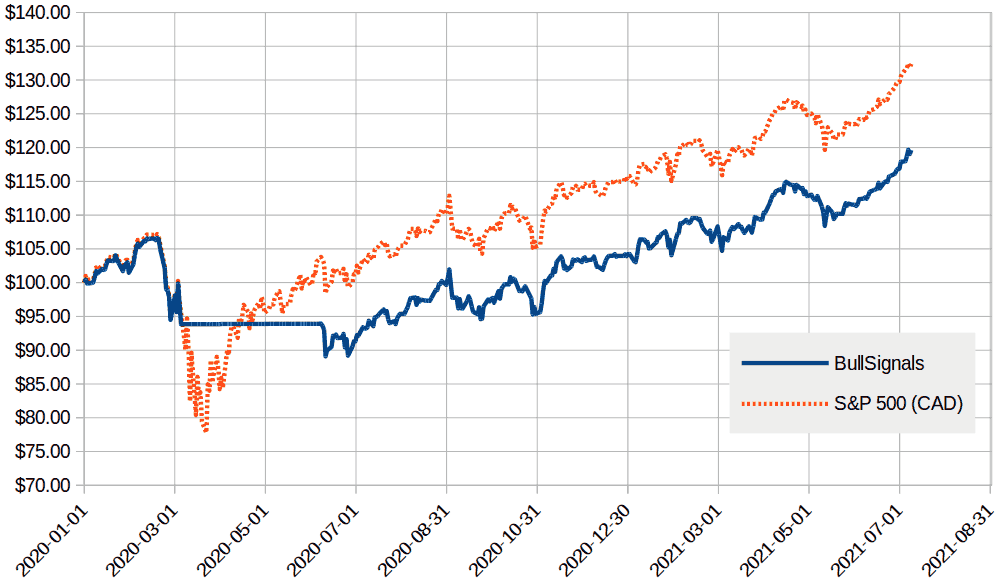

My algorithm did catch the 2020 crash, but the overall outcome is a mixed bag. Now that some time has passed, I think it might be helpful to look at the result.

I reset my tracking at the start of 2020, so I can only show this period.

The Results

My algorithm currently trades ZSP, the S&P 500

index in CAD. The numbers, such as the maximum drawdown during the

crash, are shown with a daily granularity.

| Metric | BullSignals | ZSP index |

|---|---|---|

| Maximum drawdown | -16.4% | -28.9% |

| CAGR since Jan 1, 2020 | +12.5% | +20.3% |

The algorithm successfully got out of stocks early in the crash, cutting the drawdown in half. As a consequence, the algorithm also missed the first part of the rebound, resulting in some performance loss.

Discussion

The tradeoff seen above is pretty typical for risk control or hedging strategies. This is exactly what I expected when I first wrote about this, two years ago:

I think the most likely outcome over several years is lower performance than buying and holding the index, but also less volatility (milder drawdowns). I also suspect that the algorithm will be more successful in turbulent markets.

One thing I’m very proud of here is that my algorithm generated very few buy/sell signals through this volatile period. There were only two trades since the start of 2020.

I’m still not sure how I feel about these results. My algorithm significantly reduced the maximum drawdown of the crash (which is great), but the performance loss is also significant. The counter-argument might be: just how bad is 12.5% CAGR through this much turmoil? Someone recently pointed me to a trend-following ETF from Alpha Architect, and on a CAD basis, theirs only performed at 3.9% CAGR through the same period.

So as far as trend-following techniques go, BullSignals seems pretty good.

Overall, I still like this risk control strategy, and will continue to run BullSignals for at least a few more years.

— Jem Berkes