CapitalTime

Articles on investing and capital management, with a quantitative focus.

Adding back into PRP

2021-02-17

I withdrew some of my PRP back in August, and made a commitment to reinvest the money once it was possible to do so.

Today, I reinvested everything that I had liquidated earlier. Due to my asset allocation targets, I bought only the assets that I was underweight in:

- bonds (XBB)

- gold (CGL.C)

According to the PRP rules, I had to buy these things. I didn’t buy any stocks, since I’m already above my 30% target weight.

Asset allocation is nifty

Asset allocation techniques use target % weights for the different assets in the portfolio. When adding money (buying), you are supposed to get as close as possible to the target weights.

This is a nifty approach, because it automatically steers you into buying whichever asset is relatively low or depressed.

I can illustrate this visually.

Here are charts for the three asset classes in PRP. Each chart begins at the date when I last rebalanced my portfolio back to the target weights. Therefore, the direction of each chart indicates the expansion or contraction of that asset, taking it above or below the target weight.

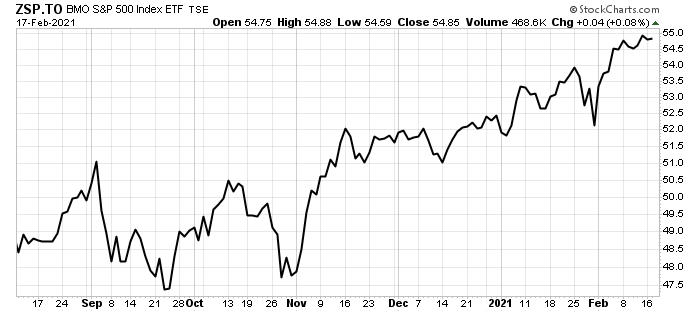

Stocks

Stocks have been very strong recently. The high performance pushed the weight of stocks above the 30% target, so they are not underweight in the portfolio. This chart only shows the S&P 500, but the Canadian TSX is up by the same amount.

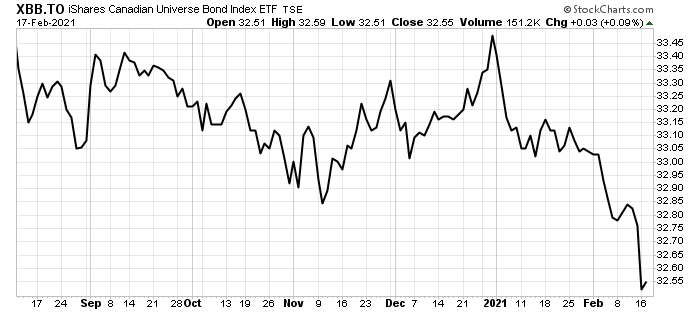

Bonds

Bonds have been weak. Their weight in the portfolio dropped, so they became underweight. New money had to buy bonds.

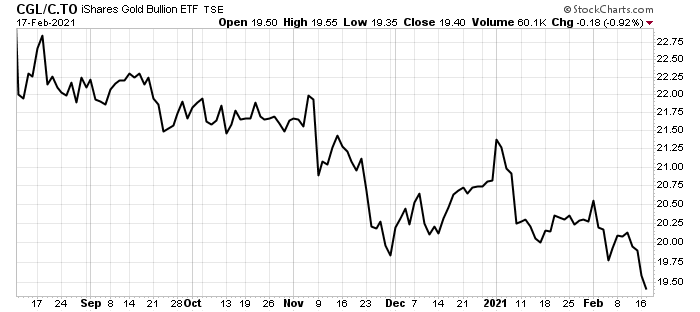

Gold

Gold has been weak as well. The weight in the portfolio dropped, and I’m now underweight gold. Therefore, new money had to buy gold.

The charts are from StockCharts.com, which has great tools. Here’s an example chart.

— Jem Berkes