CapitalTime

Articles on investing and capital management, with a quantitative focus.

Active Portfolio Annual Update

2025-07-03

These are not stock recommendations; I’m just sharing my stock portfolio. I don’t think picking individual stocks is worthwhile, but I enjoy the process and will run this portfolio for a few years.

My “Active” portfolio of individual stocks continues to outperform the Canadian index. I screen for profitability, momentum, and low beta (volatility). After today’s portfolio update, my current stocks are:

| Stock Symbol | Company Sector |

|---|---|

| DOL | Consumer |

| TRI | Professional |

| STN | Industrial |

| WSP | Industrial |

| X | Financials |

| EFN | Financials |

| FFH | Insurance |

| IFC | Insurance |

| CSU | Technology |

| TVK | Energy |

The positions are roughly equal weight, but may vary in size because of practical trading considerations. I calculate performance based on the actual portfolio and trade fill prices. Performance is net of fees, including the bid/ask spreads.

Performance

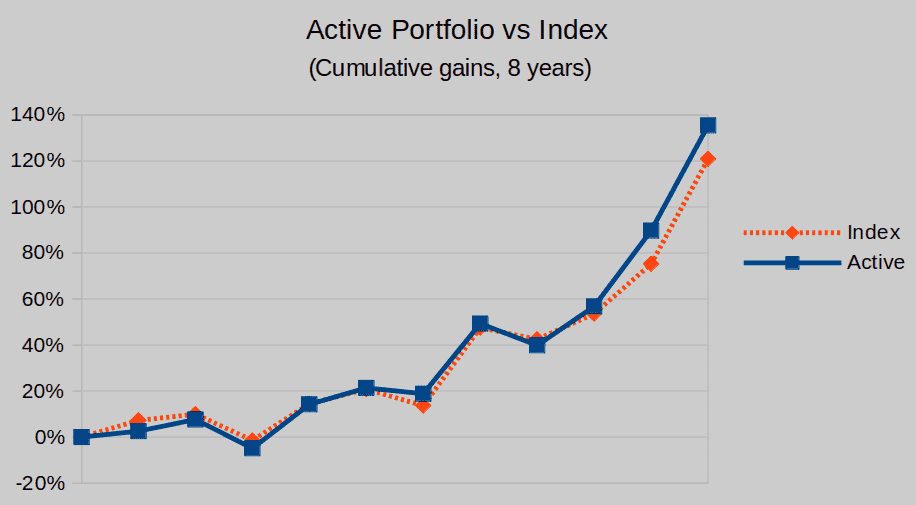

I calculate my performance using two different start dates. There’s the True Start date (2016-12-28) when I began using this strategy, and also the Pessimistic Start date (2017-06-19) which begins slightly later. The Pessimistic Start skips over early outperformance and gives an unfavourable view.

My benchmark is XIC (the TSX Composite Index

ETF).

| Starting point | Years | Active (CAGR) | XIC (CAGR) |

|---|---|---|---|

| True Start | 8.5 | 12.4% | 9.9% |

| Pessimistic Start | 8.0 | 11.2% | 10.4% |

With both start dates, the Active portfolio outperformed the benchmark. Even using the Pessimistic Start, my active strategy outperformed by 0.8% CAGR over 8 years.

This outperformance could be random luck.

Am I beating the index?

My Active portfolio is rather concentrated (typically 8 to 10 stocks) and experiences more volatility than the index. My outperformance could just be a lucky fluke, with some (random) volatility working in my favour.

This chart shows cumulative portfolio returns compared to the index since the Pessimistic Start. I’m somewhat tracking the index, but outperforming at the moment. It will be interesting to see if this outperformance continues over time.

— Jem Berkes