CapitalTime

Articles on investing and capital management, with a quantitative focus.

Growth Portfolio Annual Update

2024-06-28

These are not stock recommendations; I’m just sharing my stock portfolio. I don’t think picking individual stocks is worthwhile, but I enjoy the process and will run this portfolio for a few years.

My “Growth” stock portfolio continues to outperform the Canadian index. I screen for profitability, momentum, and low beta (volatility) but am calling this my “Growth” portfolio for lack of a better word. After today’s portfolio update, my current stocks are:

| Stock Symbol | Company Sector |

|---|---|

| DOL | Consumer |

| ATD | Consumer |

| TRI | Professional |

| STN | Industrial |

| WSP | Industrial |

| FFH | Financials |

| X | Financials |

| CSU | Technology |

| SJ | Commodities |

The positions are roughly equal weight, but may vary in size because of practical concerns such as a preference for board lots (versus odd lots), high share prices, etc. I calculate performance based on the actual portfolio and trade fill prices. Trading fees are minimal and are ignored.

Performance

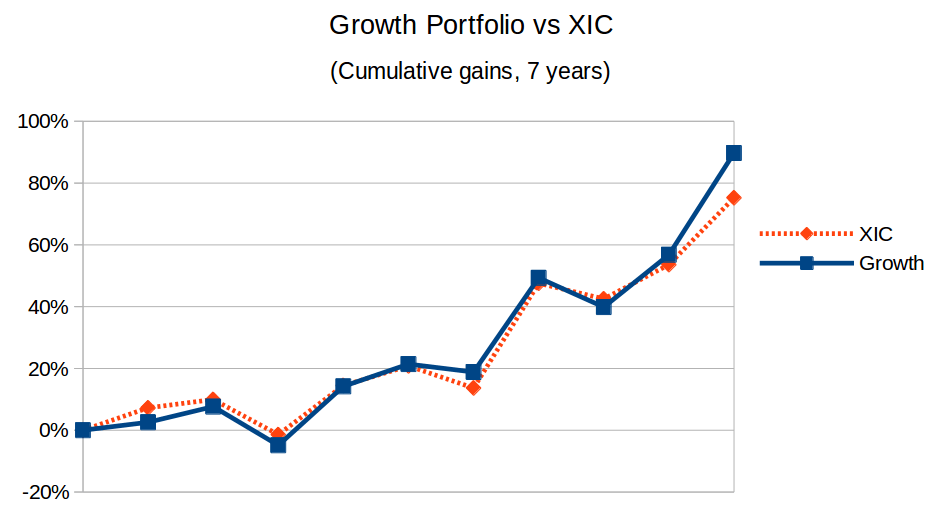

I calculate my performance using two different start dates. There’s the True Start date (2016-12-28) when I began using this strategy, and also the Pessimistic Start date (2017-06-19) which begins slightly later. The Pessimistic Start skips over early outperformance and gives an unfavourable view.

My benchmark is XIC (the TSX Composite Index

ETF).

| Starting point | Years | Growth (CAGR) | XIC (CAGR) |

|---|---|---|---|

| True Start | 7.5 | 11.0% | 7.9% |

| Pessimistic Start | 7.0 | 9.5% | 8.3% |

With both start dates, the Growth Portfolio outperformed the benchmark. Even using the Pessimistic Start, my active strategy outperformed by 1.2% CAGR over 7.0 years.

This outperformance could be random luck.

Am I beating the index?

My Growth Portfolio is quite concentrated in a few stocks, and experiences volatility. My outperformance could just be a lucky fluke, with some (random) volatility working in my favour.

This chart shows cumulative portfolio return compared to

XIC since the Pessimistic Start.

For nearly the entire history, I have closely tracked the index. The Growth Portfolio only appears to have pulled significantly ahead recently. It will be interesting to see if this outperformance continues as the years go by.

— Jem Berkes