CapitalTime

Articles on investing and capital management, with a quantitative focus.

Growth Portfolio Annual Update

2023-06-25

These are not stock recommendations; I’m just sharing my stock portfolio. I don’t think picking individual stocks is worthwhile, but I enjoy the process and will run this portfolio for a few years.

My “Growth” stock portfolio continues to outperform the Canadian benchmark. I screen for profitability and price momentum, so it’s probably not correct to use the term “Growth”. My current stocks are:

| Stock Symbol | Company Sector |

|---|---|

| DOL | Consumer |

| L | Consumer |

| TRI | Professional |

| WCN | Industrial |

| CP | Transport |

| CSU | Technology |

| IFC | Financials |

| FFH | Financials |

| TECK.B | Commodities |

The positions are roughly equal weight, but may vary because I try to minimize trades. I calculate performance based on the actual portfolio and trade fill prices, or bid/ask midpoints when positions are held through to the next period. Trading fees are ignored.

Performance

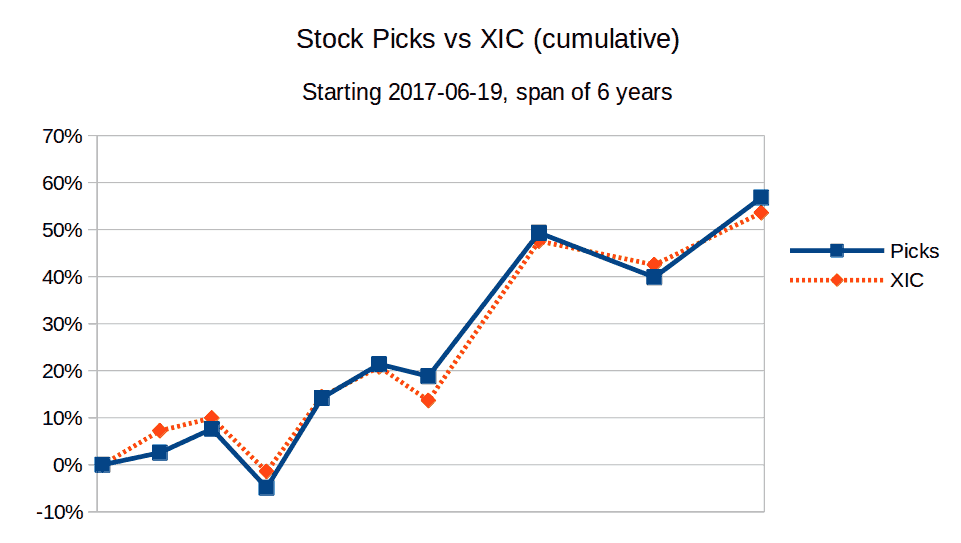

The lifetime CAGR (compound annual growth rate) since inception is 9.5%, compared to the benchmark XIC at 7.0%. This outperformance over 6.5 years looks promising, but it may also just be random luck.

| Start | End | Growth | XIC |

|---|---|---|---|

| 2016-12-28 | 2017-06-19 | 15.0% | 0.7% |

| 2017-06-19 | 2017-12-27 | 2.6% | 7.2% |

| 2017-12-27 | 2018-06-18 | 4.9% | 2.5% |

| 2018-06-18 | 2018-12-17 | -11.6% | -10.3% |

| 2018-12-17 | 2019-06-19 | 20.1% | 16.1% |

| 2019-06-19 | 2019-12-27 | 6.3% | 5.5% |

| 2019-12-27 | 2020-06-08 | -2.1% | -5.9% |

| 2020-06-08 | 2021-06-11 | 25.7% | 29.8% |

| 2021-06-11 | 2022-06-30 | -6.3% | -3.4% |

| 2022-06-30 | 2023-06-21 | 12.1% | 7.8% |

| Lifetime CAGR | 6.5 yrs | 9.5% | 7.0% |

Am I beating the index?

I’m suspicious about the first time period in the table, because early in my stock-picking, I had poor diversification and more concentrated positions. A lucky fluke in a concentrated portfolio might explain the unusual outperformance at the start.

This chart shows cumulative portfolio return compared to XIC, starting at 2017-06-19 to skip the first period. It looks like I’m more or less tracking the index!

If this kind of “index tracking” continues, there really is no point to picking individual stocks.

— Jem Berkes