CapitalTime

Articles on investing and capital management, with a quantitative focus.

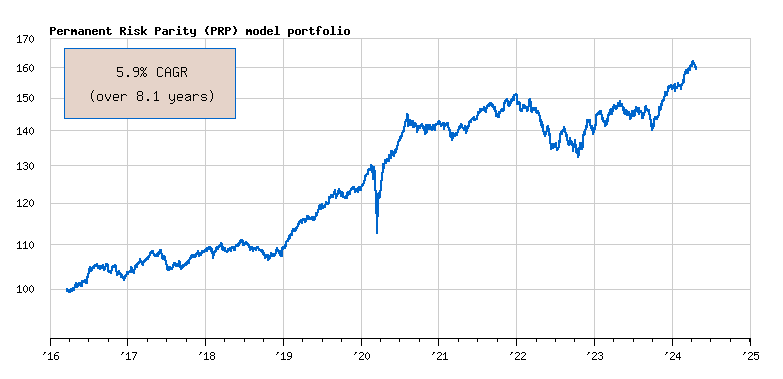

PRP: Permanent Risk Parity

The core of my investment strategy is the Permanent Risk Parity (PRP) asset allocation.

PRP is diversified among several asset classes, and has lower volatility than stock-heavy portfolios. The allocations are 40% stocks, 40% bonds or GICs, 20% gold, with annual rebalancing. My model portfolio for a Canadian PRP is:

- 20% XIU (TSX 60 stock index)

- 20% ZSP (S&P 500 stock index)

- 20% CGL.C (gold bullion)

- 40% XBB (broad Canadian bond index)

I use low-cost index funds. For a deep dive into why indexing works, see the Rational Reminder episode: The Case for Index Funds.

Warning: You should NOT copy my portfolio. These are not recommendations or advice; I’m just sharing what I’m doing.

2025-04-22

Don’t Buy Gold Miners

My portfolio includes gold bullion, meaning just the metal. I want to make it clear that I don’t invest in gold mining stocks, and in this post… #prp

2025-03-22

Nine Year Portfolio Anniversary

I started my PRP portfolio 9 years ago. Over these years, PRP has returned 7.2% CAGR. This is slightly higher than the long term historical… #prp

2025-02-24

PRP Annual Performance

The PRP allocation was up 18.2% in 2024. This was the strongest year in my historical data. Trailing 3-year and 5-year CAGR are both in the 6% to 7%… #prp

2024-12-19

Annual Rebalancing

I like to rebalance my portfolio once a year. When I updated my asset allocation in the middle of the year, the weights of some assets had already… #prp

2024-11-10

Expect a Correction

This post will be “stating the obvious”, but sometimes I like to remind myself of these things. Markets don’t run straight up, forever… #prp

2024-07-07

Updated PRP Allocations

I made a small change to my PRP allocations. The new targets are 40% Stocks… 40% Bonds… 20% Gold… #prp

2024-05-29

Preparing to Update My Asset Allocation

I have not yet changed my ‘official’ (published) PRP allocations, but am preparing to update my allocations… #prp

2024-03-22

Eight Year Portfolio Anniversary

I started my PRP portfolio exactly 8 years ago. Over these years, PRP has returned 6.0% CAGR… #prp

2024-01-17

PRP Annual Performance

The PRP allocation was up 10.6% in 2023. This was one of the stronger years in my historical data… #prp

2023-12-15

New All Time High in PRP

My PRP asset allocation reached a new all time high this month. This finally ends a rather long (nearly 2 year) period where the portfolio… #prp

2023-11-28

Peeking at Asset Class Performance

I try to focus on my overall portfolio performance, but today I peeked at the individual asset classes to look at how they… #prp

2023-03-25

Seven Year Portfolio Anniversary

I started my PRP portfolio 7 years ago. Over these years, PRP has returned 5.6% CAGR. This return is somewhat lower than… #prp

2023-02-09

Volatility and Risk-Adjusted Return

One of the main goals of my PRP portfolio is to have lower volatility, and (by extension) a better risk-adjusted return… #prp

2023-01-05

PRP Annual Performance

The PRP allocation declined -7.5% in 2022. This was the worst calendar year loss in my historical data… #prp

2022-12-28

Rebalancing My Portfolio

To maintain my portfolio allocation targets, I make sure that I invest new money into whichever asset(s) are the most underweight… #prp

2022-10-01

Not a Great Year So Far

Many asset classes have been declining this year. Like most investors, I have a negative return year-to-date (YTD). We are now entering… #prp

2022-03-22

Six Year Portfolio Anniversary

I started my PRP portfolio exactly 6 years ago. Over these years, PRP has returned 6.5% CAGR. This is a good return… #prp

2022-02-10

Yikes, inflation is very high!

Today, the US inflation rate hit a 40 year high. Canada’s inflation rate is a bit lower, but still at a multi-decade high… #prp

2022-01-18

PRP Annual Performance

The PRP gained 6.0% in 2021. In the historical context, that’s a very average year… #prp

2022-01-02

Rebalancing the Model Portfolio

I record daily values of a “model portfolio” for my PRP allocation. My actual investments are very similar, but not identical, to the model… #prp

2021-12-02

Here’s Diversification In Action

The markets have been a bit volatile over the last week. Although this is a very short timeframe, the last week provides an example of how… #prp

2021-11-14

Investment Portfolio Goals

I’ve been using the PRP investment portfolio for a while now, and thought it would be good to review my goals. Here’s what I want… #prp

2021-06-07

Why I chose XIU and ZSP

Many people have asked why I use XIU and ZSP for the equity components in my portfolio, as opposed to VEQT or XAW… #prp

2021-05-28

Buying Bonds in PRP

When adding new money to my portfolio, I look at my current asset weights to find out where I am underweight. Here’s how my portfolio looked… #prp

2021-03-23

Five Years of PRP

I started using this asset allocation on 2016-03-22, and today I am marking the 5 year anniversary. Originally, I was using the Permanent Portfolio… #prp

2021-02-17

Adding back into PRP

I withdrew some of my PRP back in August, and made a commitment to reinvest the money once it was possible to do so… #prp

2021-01-05

PRP Performance

The PRP gained 11.7% in 2020, the second highest annual return in the 25 year history… #prp

2020-11-02

Adding back into PRP

Earlier, I described a withdrawal from PRP where I sold some of my portfolio during a strong rally in stocks and gold… #prp

2020-10-16

US Version of PRP

In this post, I will present a U.S. version of the PRP. It’s essentially the same as the #prp asset allocation I use myself, except for… #prp

2020-08-10

Withdrew from PRP

I have one investment account which needs to be liquidated before moving elsewhere. This is a “forced selling” scenario… #prp

2020-06-24

Beware the high premium on MNT

My allocation to gold is currently spread across several different ETFs, as I wrote about earlier… #prp

2020-03-31

Note on MNT for gold exposure

My PRP model portfolio has 20% weight in gold bullion, which I show as MNT in the model portfolio. MNT is nice because… #prp

2020-03-09

PRP Response to Market Crash

Today saw historic moves in the stock market. The S&P 500 declined 7.6% and Canada’s TSX fell an incredible 10.3%… #prp

2020-01-09

PRP Performance

The PRP gained 13.3% in 2019, the largest annual return in the 24 year history. This was an unusually strong year… #prp

2019-08-12

Derivation of a Risk Parity Portfolio

After learning about the risk parity concept, I tried deriving my own portfolio using three uncorrelated assets that I like… #prp

2019-07-26

What is Risk?

As far as I know, there is no universally accepted definition of risk for investment modelling. Modern Portfolio Theory (MPT), introduced by Markowitz… #prp

2019-07-03

Risk Parity Doesn’t Require Leverage

There are many variants of risk parity. Some risk parity hedge funds use leverage. Others dynamically adjust weights… #prp

2019-06-24

Risk Parity - Basics

Harry Markowitz, recipient of the Nobel Prize in Economics, called diversification ‘the only free lunch in finance’… #prp